Summary

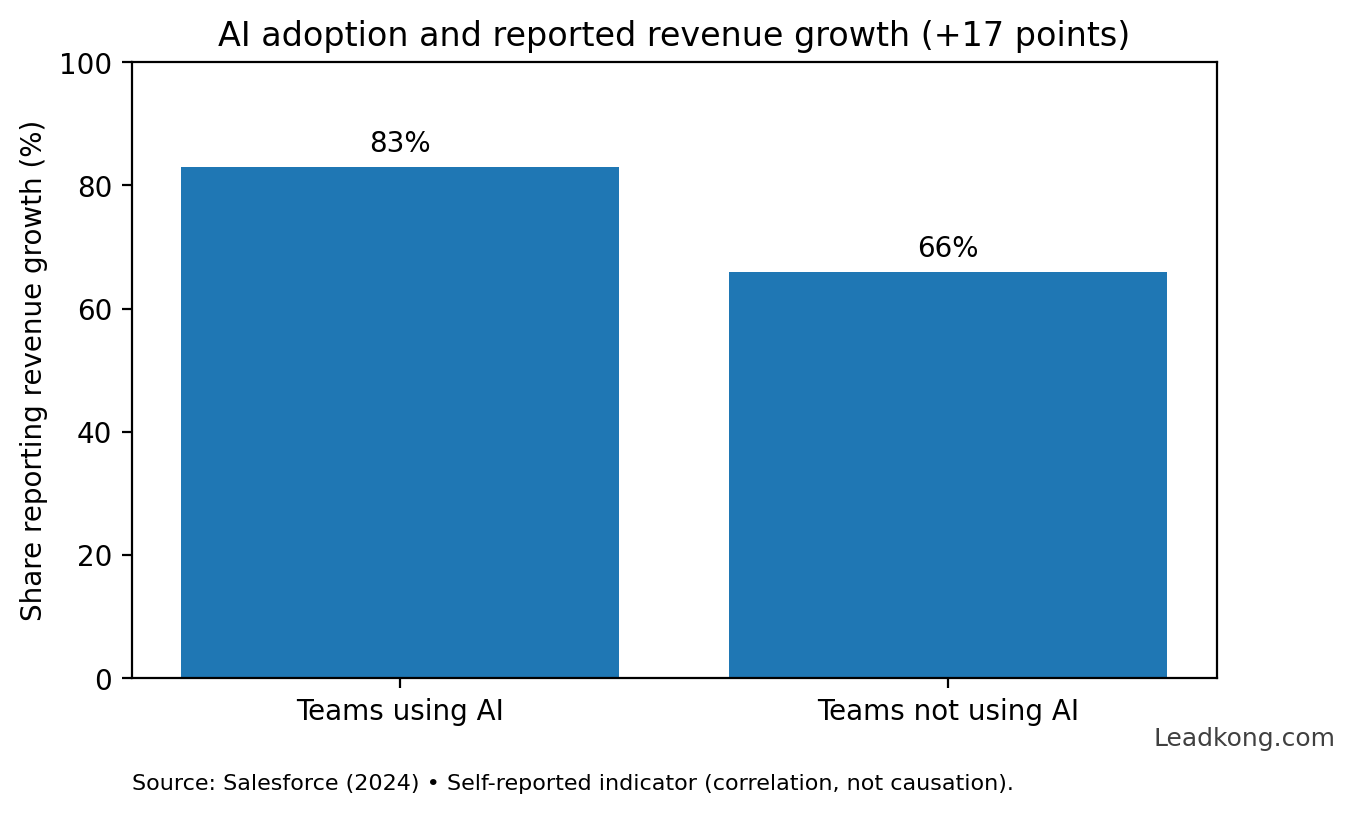

This meta-synthesis consolidates converging findings (consulting firms, SaaS vendors, academic literature) on the impact of generative AI in B2B sales through 2030. The dominant signal is not a massive replacement of salespeople, but a reconfiguration of work: accelerated automation of standard tasks, migration of journey segments toward digital/self-serve, and a shift in value toward advisory, complex negotiation, and orchestration. Productivity gains appear significant but conditional (data quality, processes, adoption, governance). The most communicable and comparative indicator in the corpus is the declared revenue growth gap between teams using AI and those not using it: 83% vs 66% (+17 points) [4].

Key Messages

1. Generative AI primarily automates tasks, not entire roles. The expected consequence is a reconfiguration of daily activities, rather than an immediate disappearance of the sales function [2][3].

2. The expected impact is primarily a compression of standard work (CRM, emails, reporting) and a reallocation toward high-value client interactions (discovery, executive alignment, negotiation) [1][6].

3. Performance increases especially when AI is integrated into the workflow (data, process, enablement) rather than added as an isolated tool [1][3].

4. Salient comparative signal: 83% of teams using AI report revenue growth vs 66% without AI (+17 points) [4].

5. 2030 horizon: digital-first and self-serve are advancing, which polarizes roles between transactional (more automatable) and complex (more human) [7][8].

1. Research Question and Scope

Question: through 2030, what can a multi-source corpus infer about (i) automation of sales tasks, (ii) productivity, (iii) value creation and role reconfiguration?

Scope: B2B sales and associated "revenue" functions (SDR/inside, AE, sales ops/RevOps, enablement). The text aims for a narrative meta-synthesis. This is not a homogeneous statistical meta-analysis in the biomedical sense, as metrics and observation methods are heterogeneous (surveys, SaaS data, consulting analyses, projections).

2. Meta-Synthesis Methodology

2.1. Types of Evidence Used

- Large-scale surveys: perception, adoption, declarative comparisons (e.g., Salesforce, HubSpot) [4][5][6].

- Consulting reports: mechanisms, role design, orders of magnitude, transformation scenarios [1][2][3].

- Analyst projections: digital-first trajectories, self-serve shift, implications for sales organization [7][8].

- Academic literature: emerging themes, methodological limitations, agentic scenarios (when available) [9][10].

2.2. Selection Criteria (Pragmatic)

- Explicit quantification of effects (time, productivity, growth) or testable operational mechanisms.

- Institutional credibility and minimum traceability (report, methodology, scope).

- Source diversity (avoiding single-vendor synthesis).

2.3. Structural Limitations

- Self-reporting bias in surveys (possible overestimation, causality not proven) [4][6].

- Overrepresentation of "sales-tech" sectors and mature markets (generalization should be handled with caution).

- 2030 projections sensitive to deployment conditions (CRM quality, integration, compliance, change management) [1][3].

3. Results

3.1 A Robust and Actionable Comparative Indicator: +17 Points

Salesforce reports that 83% of teams using AI declare revenue growth, compared to 66% for those not using it, a +17 point difference [4]. This statistic should be presented as an association (not causal proof), but it is useful because it is simple, comparable, and narratively stable.

Figure 1. Declared revenue growth: teams with AI vs without AI. Declarative indicator (correlation, not causation). Source: Salesforce [4].

3.2 Time Reallocation: Administrative Compression, Useful Interaction Expansion

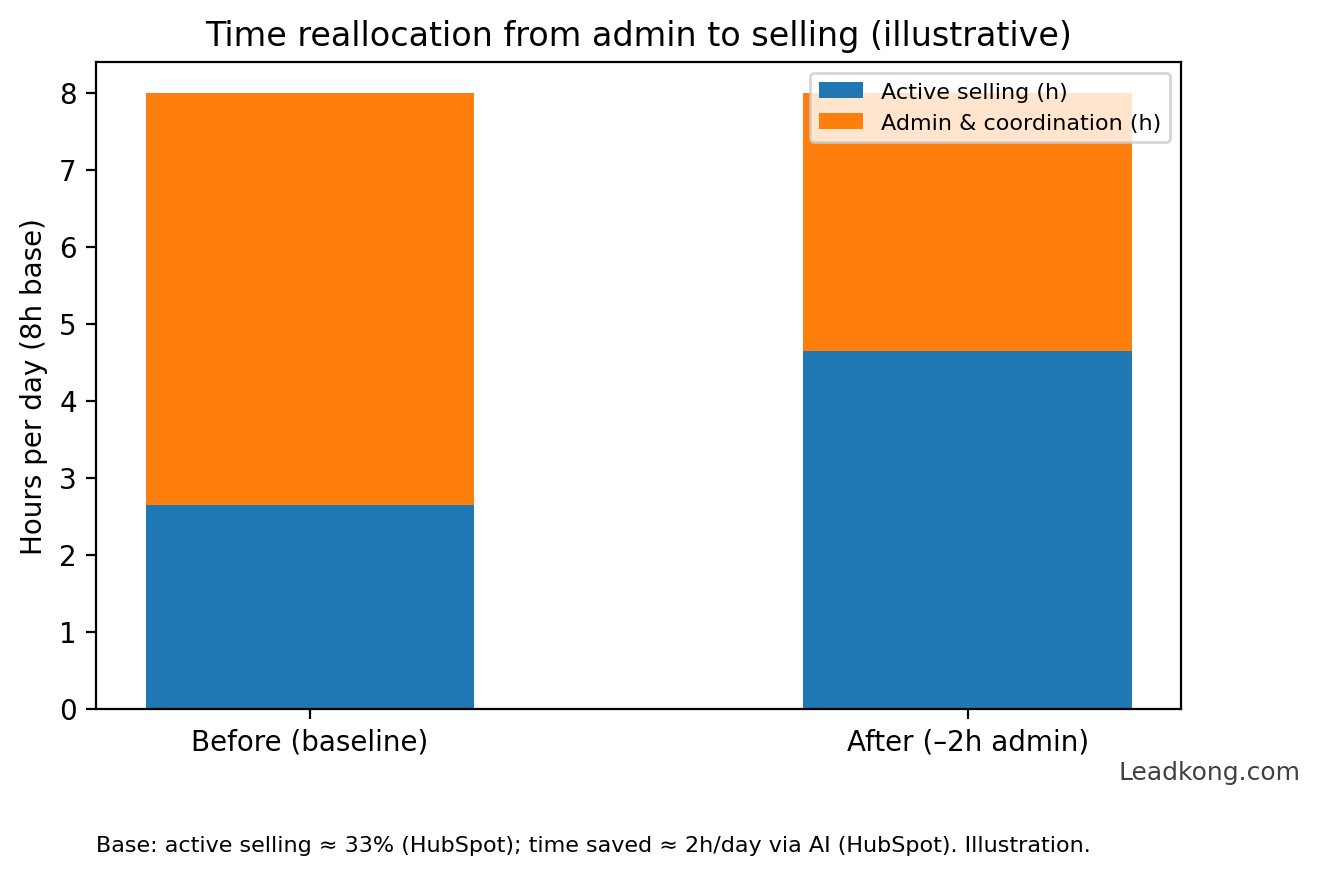

HubSpot reports approximately 2h/day saved via AI on administrative tasks [6]. This time savings is consistent with "sales automation" approaches (standardization and friction reduction) and supports the central value creation mechanism: more capacity available for discovery, client coordination, and negotiation [1][6].

Figure 2. Time reallocation (illustrative, 8h base). Assumptions from HubSpot: active selling ≈ 33% and gain ≈ 2h/day via AI [6].

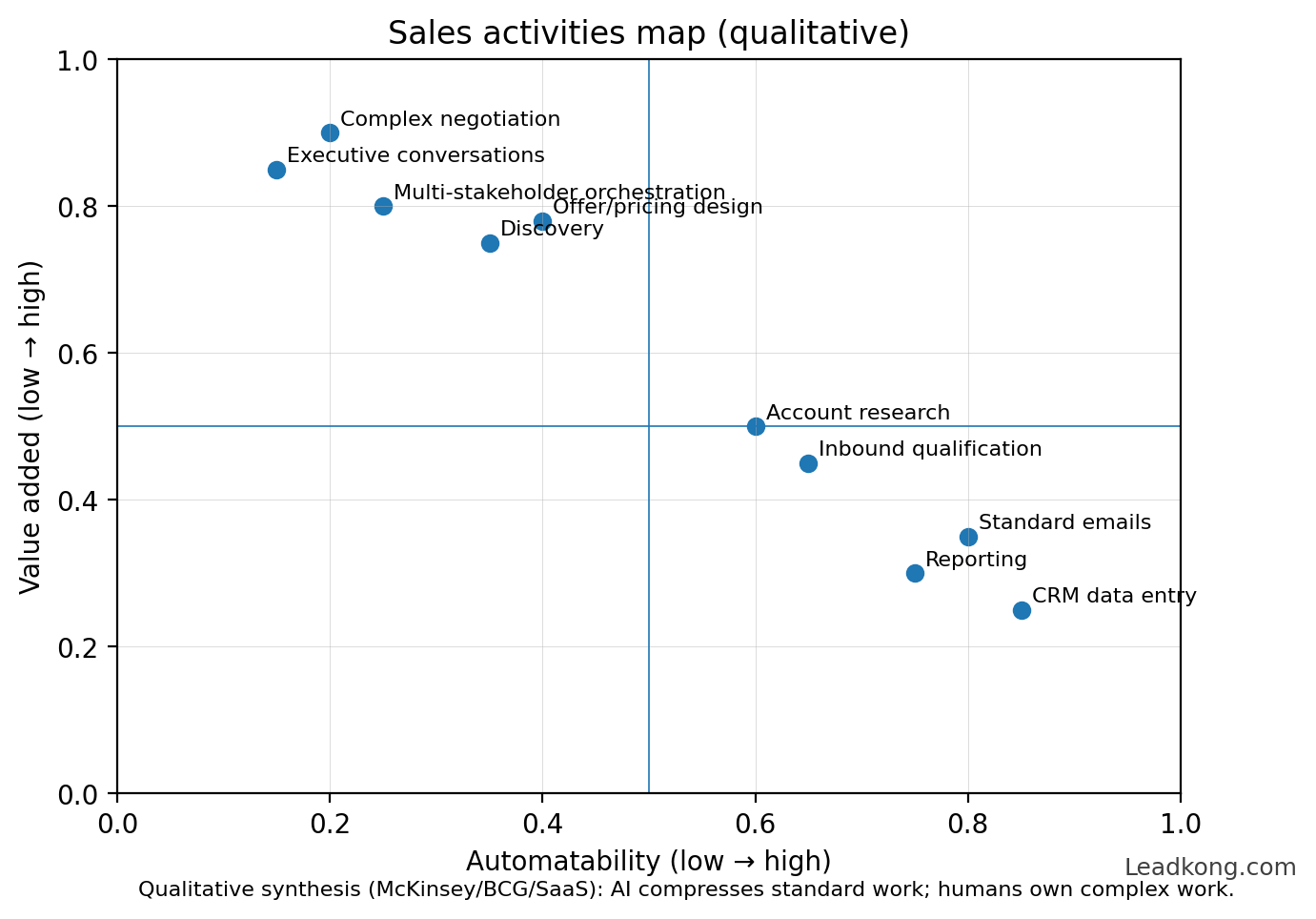

3.3 Task Reconfiguration: AI Takes the Standard, Human Focuses on the Complex

The most stable consensus in the corpus is targeted substitution of repetitive tasks rather than direct replacement of the sales role. Standardizable activities (CRM entry, template emails, reports, pipeline sorting, support preparation) are absorbed first; human value concentrates on high-entropy interactions: diagnosis, multi-party persuasion, negotiation, arbitration, trust [1][2][3].

Figure 3. Qualitative mapping. AI compresses the standard; humans dominate complex interactions [1][2][3].

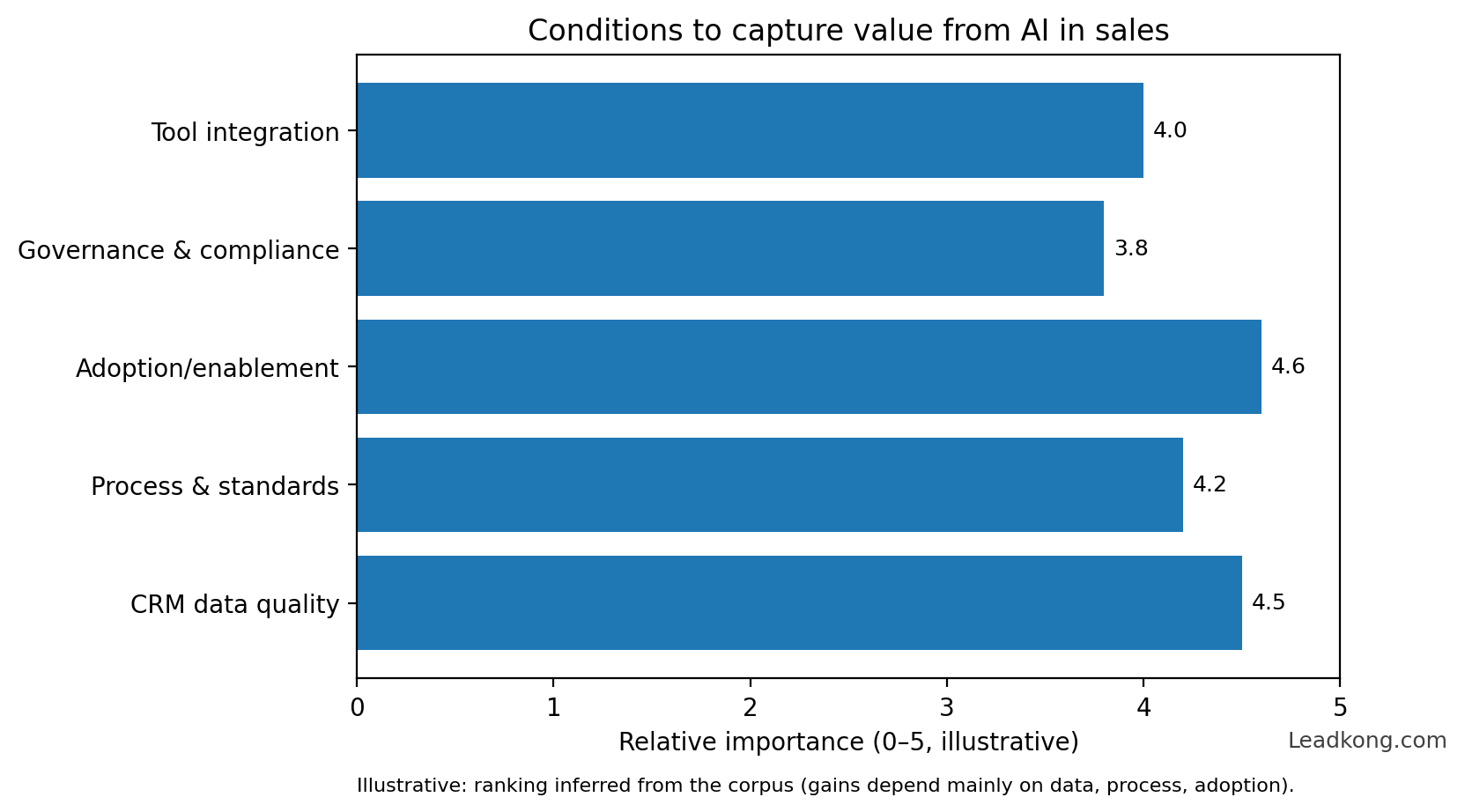

3.4 Value Capture: Why Gains Are Not Automatic

The most ambitious results (strongly increased productivity) are conditional on data quality, process standardization, field adoption, and governance (compliance, traceability, security). Without these prerequisites, AI mainly industrializes existing inconsistencies [1][3].

Figure 4. Illustrative prioritization of success conditions. Narrative synthesis: data, process, adoption dominate [1][3].

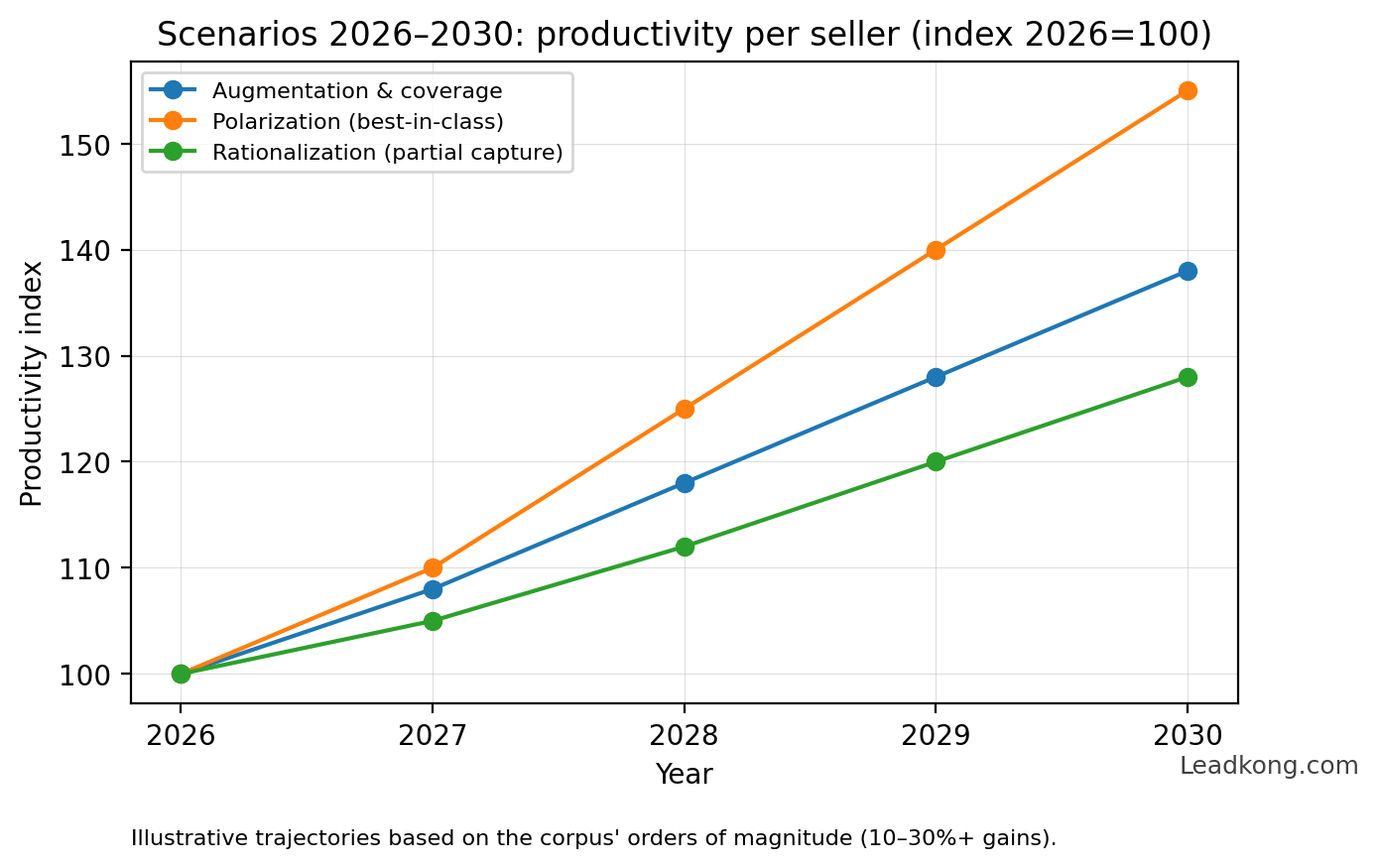

4. 2026–2030 Projections (Structured Scenarios)

The goal of scenarios is not to predict precisely, but to make the most plausible trajectories testable based on observed mechanisms.

Figure 5. Prospective trajectories 2026–2030 (illustrative). Orders of magnitude consistent with productivity gain ranges from the corpus [1][3][4].

4.1. Probable Invariants

- Digital-first: a majority of B2B interactions shift to digital environments, which reduces the salesperson's value as "information carrier" and increases their value as "orchestrator" [7].

- Self-serve: a growing share of transactions, including high-value ones, move toward self-serve channels, shifting the human role toward complex deals and exceptions [8].

- Skill polarization: relative decrease in the value of standard tasks, relative increase in complex relational and cognitive skills (negotiation, storytelling, executive conversation) [2][3].

4.2. Three Testable Scenarios

1. "Augmentation & coverage" scenario

Gains are reinvested to cover more accounts, personalize more, increase useful cadence. Overall employment may remain stable, but roles evolve toward an augmented, data-driven model [3][4].

2. "Polarization" scenario

Contraction of transactional roles and rise of high-value roles (enterprise, advisory, negotiation), plus growth of infrastructure functions (RevOps, enablement, data). Compatible with the rise of digital-first and self-serve [7][8].

3. "Rationalization" scenario

Gains become a cost reduction lever (do the same with less), especially in constrained market contexts. This scenario is more dependent on economic conditions and internal trade-offs than on technology alone.

5. Operational Implications

5.1. Role Design

Clarify the "AI vs human" boundary by activity, and redesign SDR/AE/RevOps around a value chain: qualification, diagnosis, solutioning, negotiation, renewal. Organizations that do not redesign roles capture less value, even with good tools [1][3].

5.2. Measurement and Management

Prioritize production and decision metrics rather than "usage rate":

- admin time vs client time,

- cycle velocity,

- forecast quality,

- CRM data quality,

- conversion rate at critical stages [1][6].

5.3. Governance

AI amplifies the quality of the existing system. Without reliable data and governance rules (confidentiality, compliance, traceability), the organization mainly industrializes its errors.

6. Limitations and Interpretation Cautions

- The +17 point differential (83% vs 66%) is a declarative comparison. It is useful for communication but should not be sold as causal proof [4].

- Productivity orders of magnitude "up to 2x" are potentials under conditions, not a universal promise [3].

- Digital-first and self-serve projections structure a plausible trajectory, but their diffusion speed depends heavily on sector, buying cycle, and regulatory constraints [7][8].

Conclusion

Through 2030, generative AI does not replace "the salesperson" wholesale. It replaces a growing share of standard sales work and reconfigures the function around digital orchestration and complex interaction. The productivity gain is real but conditional. For a quantified conclusion, strictly sourced and easy to understand: 83% of teams using AI report revenue growth vs 66% without AI, a +17 point difference [4].

Sources

[1] McKinsey (2020). Sales automation: The key to boosting revenue and reducing costs (PDF). mckinsey.com...

[2] McKinsey (2024). An unconstrained future: How generative AI could reshape B2B sales. mckinsey.com...

[3] BCG (2023). Get Your B2B Sales Team Ready for the Power of Generative AI. bcg.com...

[4] Salesforce (2024). Sales Teams Using AI 1.3x More Likely to See Revenue Increase (Newsroom). salesforce.com...

[5] Salesforce Research (2024). State of Sales Report (6th edition) (PDF). assets.ctfassets.net...

[6] HubSpot (2024). HubSpot's 2024 Sales Trends Report (PDF). hubspot.com...

[7] Gartner (2020). 80% of B2B Sales Interactions Between Suppliers and Buyers Will Occur in Digital Channels by 2025 (press release). gartner.com...

[8] Forrester (2024). Forrester's B2B Marketing & Sales Predictions 2025 (press release). forrester.com...

[9] ScienceDirect (2025). Artificial intelligence in sales research: Identifying emergent themes and looking forward (Journal of Business Research). sciencedirect.com...

[10] ScienceDirect (2025). AI agents, agentic AI, and the future of sales (Journal of Business Research). sciencedirect.com...